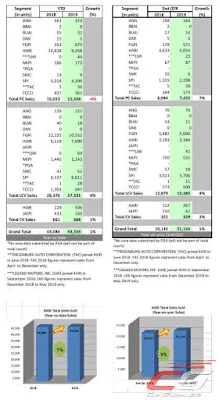

The Association of Vehicle Importers and Distributors (AVID) reports that its members showed a slight recovery in vehicle sales in the first six months of 2019. Sales during the first half of the year reached 43,333 units—a one percent increase over the same period last year.

Interestingly, majority of the growth—a 5 percent increase (21,134 units)—happened during the second quarter of 2019, showing that the Philippine automotive industry is on its way to a steady recovery.

“Despite headwinds that include an economic slowdown in the first quarter of 2019, AVID posted a third straight month of positive growth to finish the second quarter strong. We believe that this slowdown is temporary since the Philippines is now on a higher growth path and is a leading economy in the ASEAN. Given these, we will continue to introduce exciting models and innovative services to give consumers more value for their money,” said AVID President Ma. Fe Perez-Agudo.

Segmented by vehicle type, Passenger Cars (PC) sales remained weak with a 4 percent year-to-date drop with 15,336 units sold compared to the same period last year. That said, sales did rise 7 percent or 7,422 units) in Q2 2019 when compared to Q2 2018.

Hyundai remains AVID’s top volume driver in the PC segment with 9,458 units sold, followed by Suzuki at 4,206, and Ford at 675.

Meanwhile, the Light Commercial Vehicles (LCV) segment grew 4 percent in year-to-date sales with 27,331 units sold versus the same period of 2018. In the second quarter of 2019 alone, LCV sales recorded an increase of 4 percent with 13,383 units sold versus Q2 2018.

The LCV segment remains to be AVID’s top volume driver which is led by Ford with 10,552 units sold followed by HARI with 7,690 units, and Suzuki with 6,611 units sold in the first half of 2019.

Finally, Commercial Vehicles (CV) segment sales in the second quarter saw an increase of 2 percent with 329 units sold versus same period last year. The overall YTD sales of CV units gained 1 percent with 666 units sold versus the same period last year. Hyundai trucks and buses continues to dominate the CV market with over 500 trucks and buses sold from January to May 2019.

In terms of brands, premium automakers continued to experience softer sales in 2019 with distributors such as Auto Nation Group (Mercedes-Benz, Chrysler, Jeep, Dodge, RAM) and DBPHILS Motorsports, Inc. (Aston Martin) both reporting lower sales during the first half of 2019. PGA Cars, Inc. (Audi, Porsche, Bentley, Lamborghini) meanwhile did not report any sales data to AVID.

Looking at mainstream brands, Ford’s PC sales (EcoSport is classified as a PC) are starting to recover, though its LCV line-up composed mostly of the Everest and Ranger has gone down. The same can be said about Motor Image Pilipinas (Subaru) which sees their PC sales (Subaru XV, Impreza, WRX, etc.) go up slightly, but its LCV (Forester, etc.) drop. Heaviest hit is TCCCI. PC sales dropped 56 percent, while their LCV sales dropped 27 percent. TCCCI did not include figures for MG in this report.

Editor’s Note:

- ANG – Auto Nation Group (Chrysler, Jeep, Dodge, Mercedes-Benz)

- BBAI – British Bespoke Automobiles, Inc. (Rolls-Royce)

- BUAI – British United Automobiles, Inc. (Lotus, MINI)

- DMI – DBPHILS Motorsports, Inc. (Aston Martin)

- FGPI – Ford Group Philippines, Inc. (Ford)

- HARI – Hyundai Asia Resources, Inc. (Hyundai)

- MIPI – Motor Image Pilipinas, Inc. (Subaru)

- JAIPI – JAC Automobile International Philippines (JAC)

- PGA – PGA Cars, Inc. (Audi, Bentley, Lamborghini, Porsche)

- SMC – Scandinavian Motors Corporation (Volvo)

- SPI – Suzuki Philippines, Inc. (Suzuki)

- TAC – Triesenburg Auto Corporation (Kinglong)

- TCCCI – The Covenant Car Company, Inc. (Chevrolet, MG)

No comments:

Post a Comment

Feel free to comment or share your views. Comments that are derogatory and/or spam will not be tolerated. We reserve the right to moderate and/or remove comments.